As we begin the first quarter of the year, we are grateful for the continued growth in the number of investment accounts entrusted to the Florida United Methodist Foundation. More churches are choosing the Foundation and our investment advisor, CapTrust, to walk alongside them as faithful stewards of resources set aside for ministry—today and for generations to come.

Over the past year, we have had the privilege of working closely with congregations to craft thoughtful spending policies, clarify long-term goals, and align financial decisions with ministry vision. These conversations consistently remind us that investing is not about chasing short-term results, but about creating sustainable support for mission, outreach, and faithful witness well into the future.

The current market environment continues to reflect a mix of opportunity and uncertainty—shaped by inflation trends, interest rate expectations, global events, and shifting economic signals. In times like these, the importance of diversification and a disciplined, long-term strategy becomes even more evident. Our investment approach is intentionally diversified across asset classes and time horizons, seeking to manage risk prudently while positioning portfolios for steady growth over the long run.

This measured approach is designed not to react to headlines, but to support ministry with consistency and resilience. These quarterly investment newsletters are intended to provide clear, informed insight into the market environment and our long-term investment approach, helping churches and ministry leaders stay grounded, informed, and confident as they steward resources in service of God’s work.

ECONOMIC OUTLOOK

| 2025 defied expectations, as markets shrugged off tariff and inflation fears to deliver a third consecutive year of strong returns. Technology stocks again propelled global markets amid unprecedented investment in AI infrastructure. Investors enter 2026 with high hopes for tax relief, investment incentives, and lower interest rates. However, lingering unknowns about AI payoffs, energy and labor constraints, mounting federal debt, and sticky inflation risk could rain on the parade. |

HEADWINDS

Real World Limits

- Investors are anxious to see a return on investment from trillions of dollars of AI commitments, but aging power grids and long lead times may limit deployment speed.

Policy Squeeze

- Tighter immigration policy and higher input costs from tariffs are colliding with a significant cash injection from tax reform. The resulting pressure could complicate the Fed’s path to lower interest rates and further escalate federal debt and deficit concerns.

Priced to Perfection

- Elevated valuations may limit further gains in investor optimism. Historic levels of concentration in a small group of technology stocks leave markets more susceptible to pullbacks if AI investments disappoint.

TAILWINDS

A Global Investment Supercycle

- Tax provisions in the One Big Beautiful Bill Act (OBBBA) could supercharge U.S. business investment. Meanwhile, a synchronized global push to rebuild defense capabilities, plus continued investment in power and computing infrastructure may create a price floor for real assets.

Tax Refund Windfalls

- Under the OBBBA, tax refunds are poised to rise by 44% year-over-year. Sustained highs in stock and housing markets continue to boost the high-end consumer.

Broadening Base

- Lower global interest rates offer support for smaller and more cyclical companies, just as AI productivity projects may start to pay off. This could deliver a long-awaited broadening of corporate profits and power the next phase of global growth.

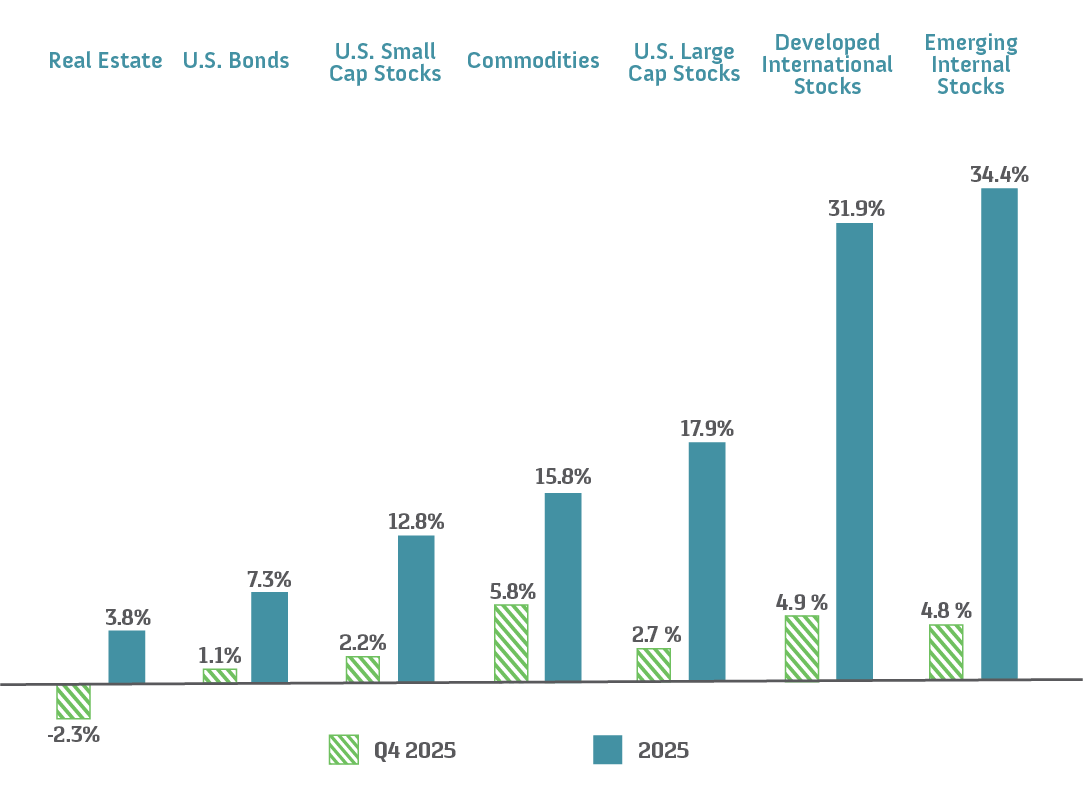

STRONG FINISH SETS THE STAGE

| Global markets ended 2025 on a strong note, buoyed by AI infrastructure spending and continued economic resilience. U.S. equity leadership began to diversify, expanding beyond the tech concentration that dominated most of the year. International stocks were the standout performers, aided by a weaker dollar, strong earnings, and pro-growth structural reforms. |

- U.S. stocks rose modestly as investors rotated out of the crowded technology trade to a broader range of cyclical and defensive sectors.

- International equities meaningfully outpaced U.S. stocks, driven by multiple expansion, currency effects, and fiscal support.

- Short-term bond yields moved lower in tandem with a third Federal Reserve rate cut. Returns were muted as investors contemplated the forward path of monetary policy.

- Commodities added to year-to-date gains as precious metals, a safe-haven asset class, climbed.

- Real estate moved lower despite falling interest rates, pressured by uncertainty over future economic conditions.

Asset class returns are represented by the following indexes: Bloomberg U.S. Aggregate Bond Index (U.S. bonds), S&P 500 Index (U.S. large-cap stocks), Russell 2000® (U.S. small-cap stocks), MSCI EAFE Index (international developed market stocks), MSCI Emerging Market Index (emerging market stocks), Dow Jones U.S. Real Estate Index (real estate), and Bloomberg Commodity Index (commodities). Past performance is no guarantee of future results. Indexes are unmanaged; do not incur management fees, costs, and expenses; and cannot be invested in directly. Please refer to the index definitions and other important disclosures provided at the end of this presentation.

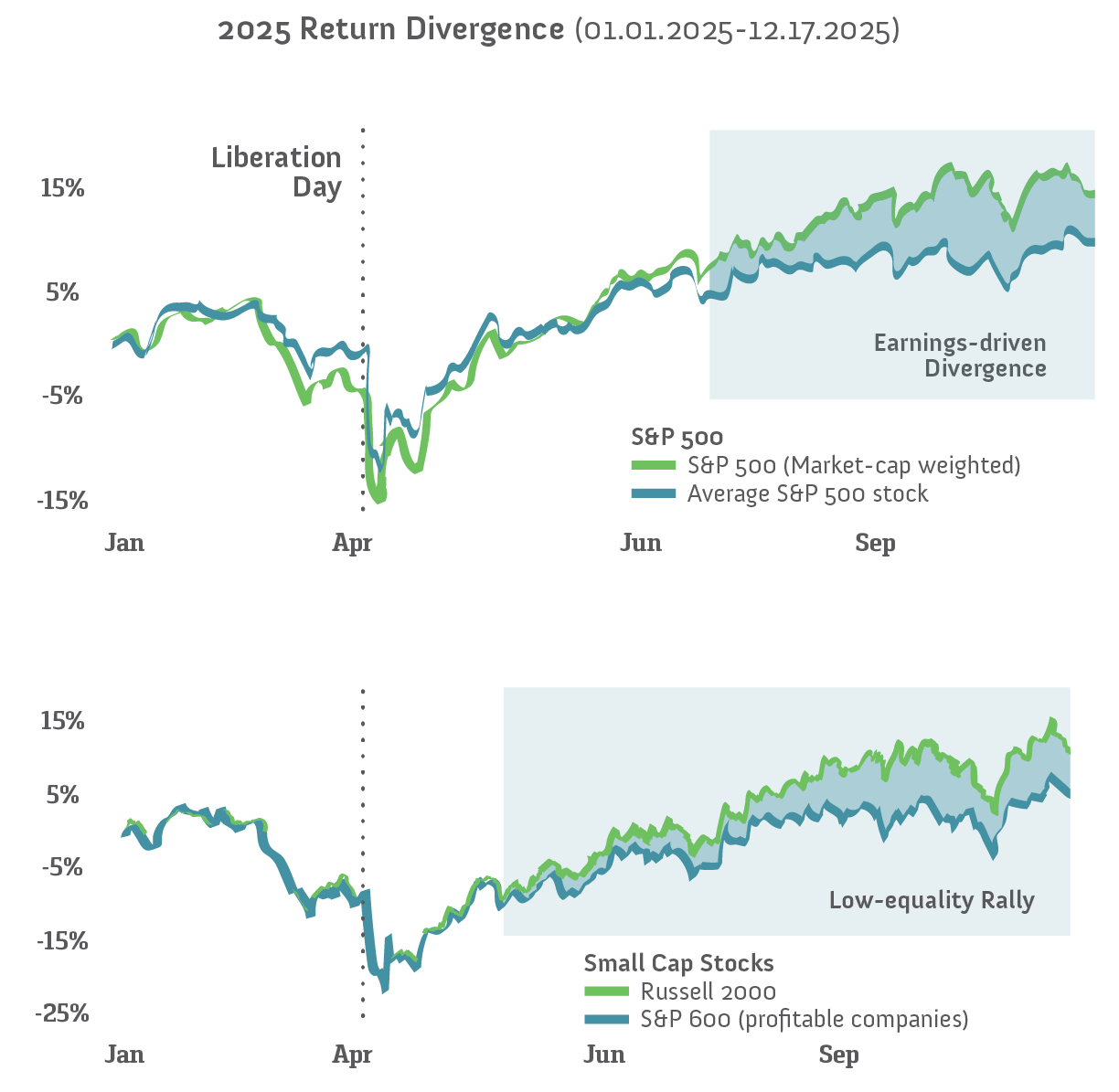

PENALIZED FOR PRUDENCE

Markets posted impressive gains in 2025, but the mechanics of the rally created unique challenges for diversified investors. Time-tested risk management practices, including asset class diversification, an emphasis on quality and fundamentals, and valuation discipline, held back performance in a market driven by historic levels of concentration and a speculative surge in lower-quality stocks.

THE DIVERSIFICATION PENALTY

- 2025’s S&P 500 returns were driven by the Magnificent 7, which grew earnings twice as fast as the average company.

- This created a challenging backdrop for active stock selection, with the median diversified fund manager trailing the benchmark by historic margins

- In some cases, standard risk controls, such as portfolio concentration limits, made keeping up nearly impossible.

THE QUALITY PENALTY

- In the small-cap universe, the market rewarded more speculative, unprofitable companies

- Of Russell 2000 Index constituents, 41% are unprofitable, yet elevated investor risk appetites propelled it well above the S&P 600 Index, which requires profitability for inclusion.

| While disciplined investors may have trailed the indexes in 2025, absolute returns were strong. Risk management seeks to dampen risk over full market cycles, even if it may limit returns during more speculative periods. |

Sources: Morningstar, FactSet, CAPTRUST research. Data as of 12.17.2025.

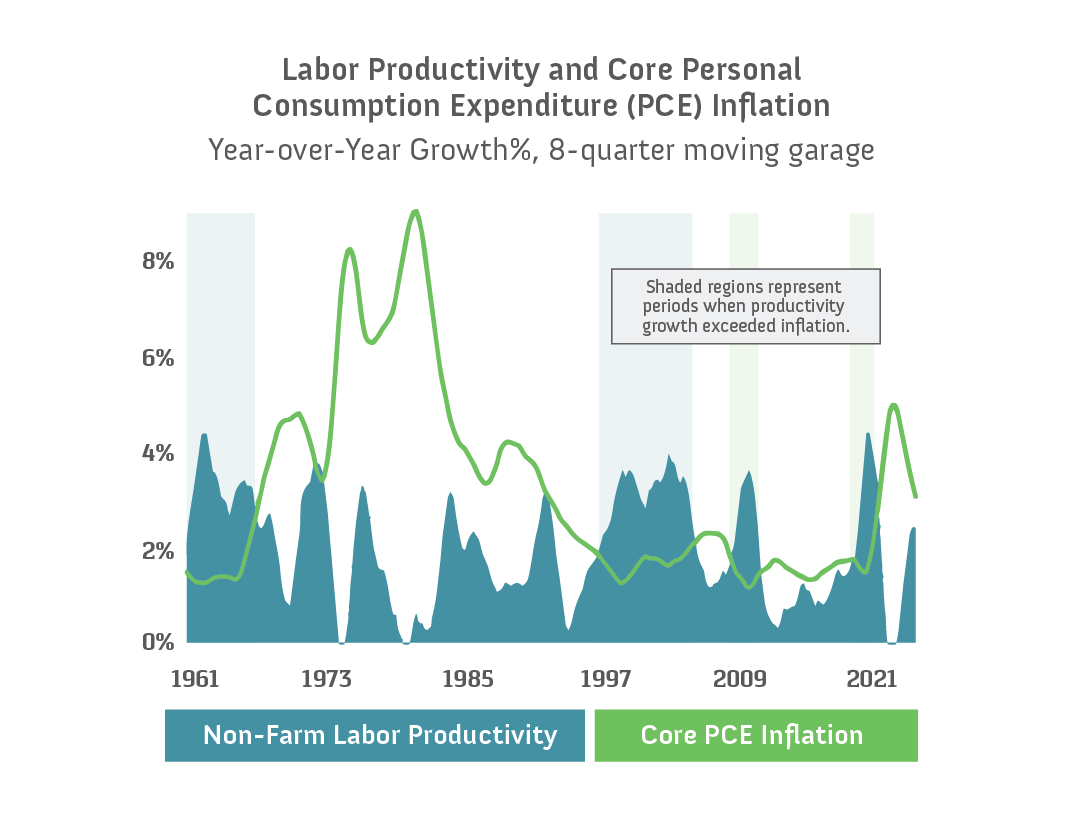

THE GREAT RACE: PRODUCTIVITY VS. PRICES

| The U.S. economy faces a unique tug-of-war. On one side, Fed rate cuts, pro-growth fiscal policies, ongoing trade friction, and immigration controls risk overheating demand amid constrained supply. On the other side, the AI revolution promises disinflationary growth. Will AI-driven efficiency win out over policy-fueled inflation? |

PRODUCTIVITY AS AN INFLATION CAP

- Productivity gains can help limit inflation by helping companies produce more with fewer resources.

- Over the past 65 years, we’ve seen several periods when the rate of productivity growth (blue) exceeded inflation (yellow).

- The 1960s and 1990s were periods of high growth supported by tech innovation.

- The others were periods of crisis recovery and a shrinking labor force.

- AI-driven efficiencies could launch a new era where productivity growth outpaces inflation. While this may raise fears of job losses, echoing concerns from the 1960s’ factory automation wave and 1990s’ retail disruption, history tells a different story.

- Technology advances rarely trigger mass unemployment. Instead, they reduce costs and unlock new demand, supporting disinflationary growth.

Sources: U.S. Bureau of Economic Analysis, U.S. Bureau of Labor Statistics, Federal Reserve Bank of St. Louis, CAPTRUST research. Please refer to definitions and other important disclosures at the end of this presentation.

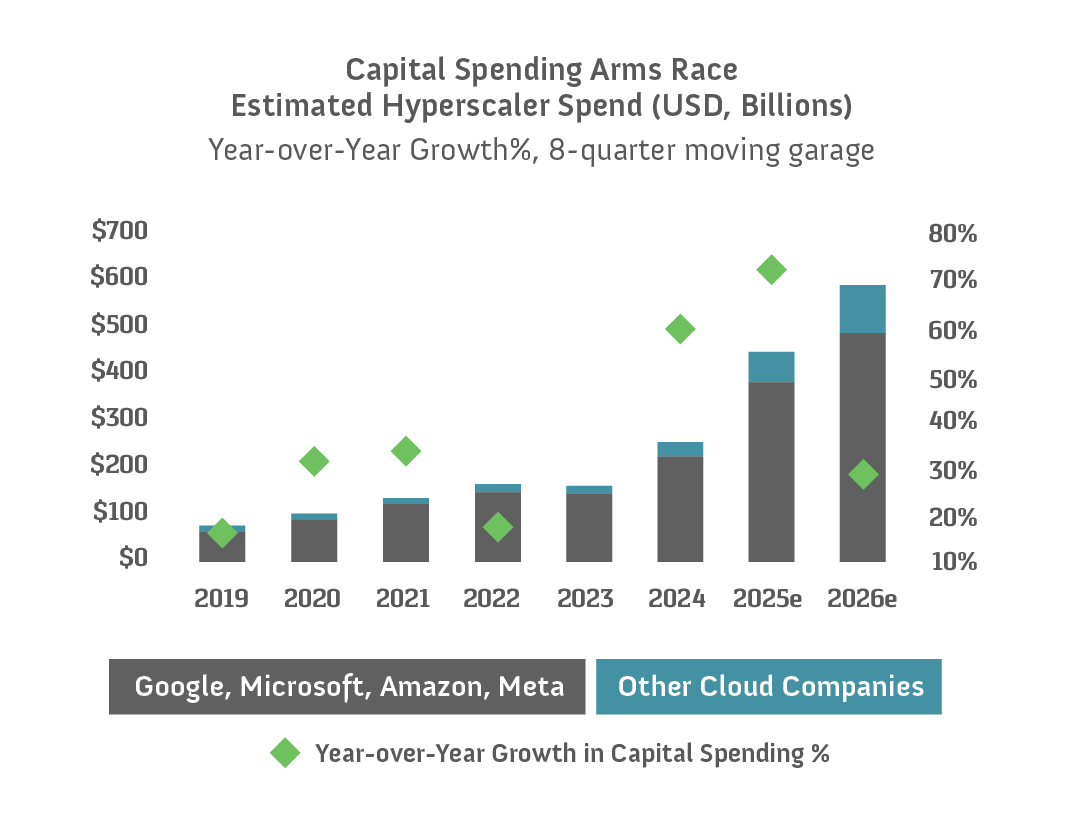

AI: MOVING FROM PROMISE TO PAYOFF

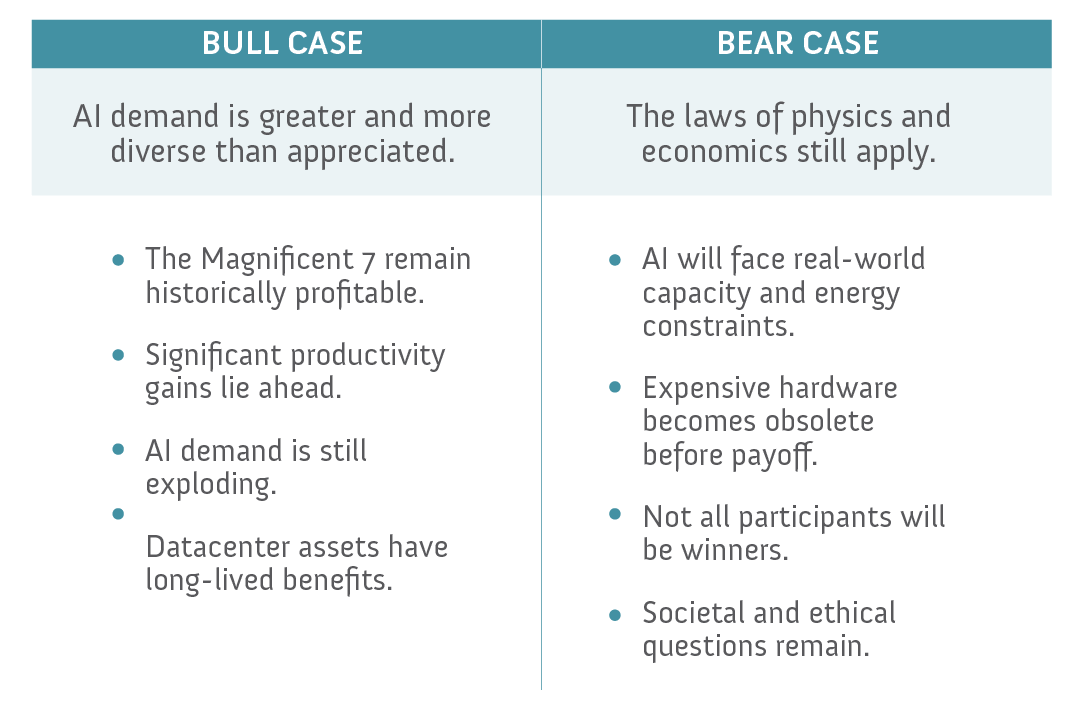

AI capital spending has been a major driver, fueling more than 50% of U.S. economic growth in 2025—a historic investment in an unproven technology. In 2026, the focus pivots from promise to payoff. Whether the next phase represents a productivity supercycle or a supply glut depends on the resolution of the biggest question facing investors today: Can AI deliver on its lofty promises?

- If AI productivity promises are realized, the infrastructure spending cycle can continue, creating a significant economic tailwind. But if pilot project returns underwhelm, investor appetite for more speculative investment may wane.

- Mega-cap tech players are in a strong position to pivot if capacity demand slows. But private players such as OpenAI, Anthropic, and other debt-funded tech companies face pressure to monetize more quickly. The speed and scale at which these investments pay off will determine the winners and losers.

Sources: JPMorgan, FactSet, CAPTRUST research. Other cloud companies include Apple, CoreWeave, and Oracle. Data as of 12.31.25. In the right-hand columns of the chart, 2025e and 2026e refer to capital-spending estimates (e), as compiled by JPMorgan