Renewed Strength Through Patient Stewardship

“But those who wait for the Lord shall renew their strength,

they shall mount up with wings like eagles,

they shall run and not be weary,

they shall walk and not faint.”

—Isaiah 40:31 (NRSV)

In seasons of challenge or change, strength doesn’t come from rushing ahead—it comes from faithfully waiting, wisely preparing, and trusting God’s unfolding plan. At the Florida United Methodist Foundation, we see our role as helping churches and ministries anchor themselves in sound financial stewardship, so they may rise with renewed strength and purpose.

Our CEFEX Certification for Fiduciary Excellence stands as a testament to that calling. This rigorous accreditation affirms that the Foundation meets the highest standards of fiduciary responsibility—a commitment we take seriously in every investment decision, consultation, and relationship.

As we move through the second quarter of 2025, our focus remains clear: to support your ministry in looking beyond the moment—toward the long-term health, growth, and vitality of God’s work in your community.

We invite you to reach out if we can provide guidance, schedule a consultation, or review your ministry’s investment strategy. It is our privilege to serve and to share the information below as part of our shared journey into the future of faithful ministry.

ECONOMIC OUTLOOK

The forward path of the U.S. economy reflects a wide range of possible outcomes as the impact of fiscal policy initiatives remains uncertain. While it is not unusual for changes to take place in the first year of a new president’s term, the pace and scale of recent policy shifts is unprecedented. Data pointing to slowing economic activity suggests that consumers and businesses are on hold. Greater clarity on trade and the size and timing of tax cuts could be a catalyst for future economic growth.

HEADWINDS

Fiscal Policy Drag

- Economic activity may stall if the uncertainty around changes in U.S. trade policy continues, further delaying investment decisions.

- The goal of tariffs, government efficiency initiatives, and immigration reform is to promote national interests. However, these policies could require businesses to adjust operations significantly.

Waning Sentiment

- Consumer and business sentiment has faded in anticipation of higher costs. Yet, any changes to pricing are more likely to create a one-time shift than to drive persistent price increases.

Fed Pause

- The Federal Reserve has adopted a wait-and-see approach; they are following the data and monitoring the impact of fiscal outcomes before making further changes to monetary policy.

TAILWINDS

Pro-Growth Policy Initiatives

- Regulatory reform and tax cuts are intended to drive growth and profitability. This could be positive for U.S. consumers and businesses. While timing remains unknown, Congress will likely want to move quickly to maintain election momentum.

- The administration’s move toward lower spending could help alleviate debt pressures. But with the impact of tax reform and monetary policy uncertain, the transition could be choppy.

Favorable Consumption Outlook

- A labor market with low unemployment and steady job creation is key for continued consumer spending. Consumers may spend more freely if rates fall and tax cuts are enacted.

- Corporate profits remain firm as companies optimize margins and incorporate incremental AI-related efficiencies. AI should drive meaningful productivity gains in the coming years, expanding profitability and overall growth.

CONTRIBUTORS TO ECONOMIC GROWTH

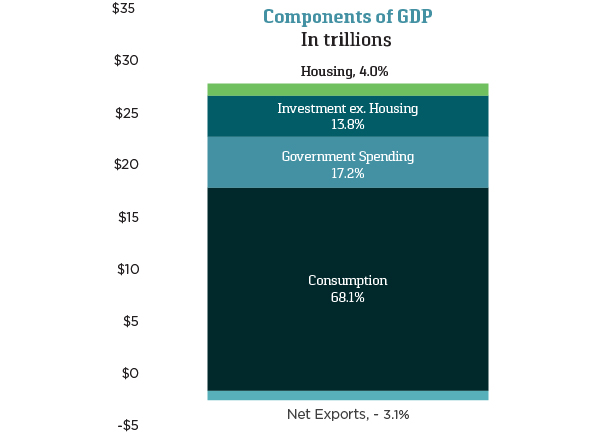

Economic growth has decelerated in recent months as fiscal policy uncertainty has altered business and consumer spending patterns. While the odds of a recession have increased, we do not believe a recession is inevitable. A review of the categories that are captured within gross domestic product (GDP) can provide insight into future economic resilience.

Government Spending

Although the Department of Government Efficiency (DOGE) has dominated headlines with spending cuts and layoffs, its $140 billion in estimated savings is just 2% of the $7 trillion federal budget. Social Security, Medicare, Medicaid, and national defense make up nearly 70% of government spending and are unlikely to be impacted.

Net Exports

In February, the Atlanta Fed forecast a first quarter GDP decline, sending investors into a frenzy. However, the forecast was influenced by a surge in imports—a detractor from GDP—as U.S. businesses ramped up foreign buying ahead of tariffs. Tariffs could ultimately subtract 1% to 2% from GDP. Nonetheless, the scare associated with the early 2025 surge in imports should quickly normalize.

Consumption

While other components of GDP create concerns, most recessions are driven by a slowdown in consumption, which accounts for nearly 70% of GDP. A labor market with low unemployment and wage growth provides support for continued consumer spending. Additionally, lower rates and potential tax cuts could provide additional spending capacity, helping to offset growth challenges elsewhere.

Sources: Bureau of Economic Analysis, CAPTRUST research

OUTLOOK DIVIDES GLOBAL MARKETS

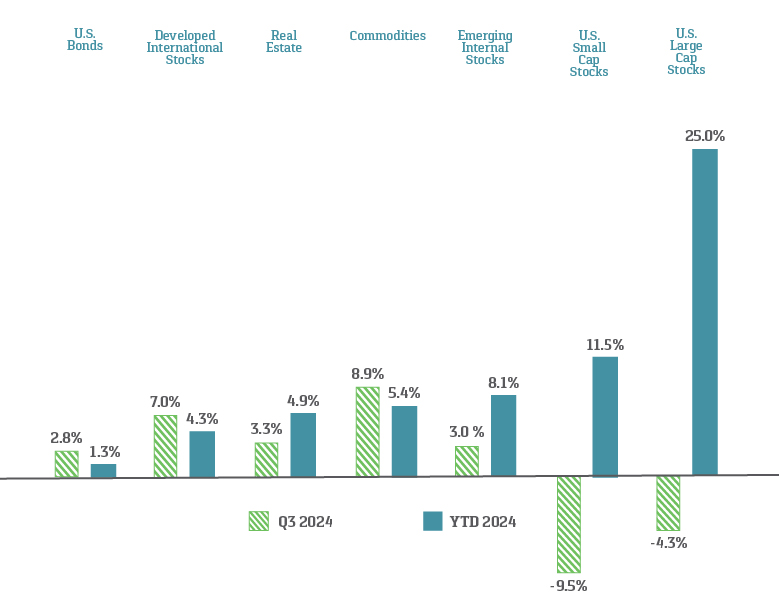

Global equities started the year off strong but ended the quarter on a cautious note as policy rhetoric dominated the narrative. Performance varied by region. In the U.S., equities were pressured by a reevaluation of growth prospects. Overseas, new growth-oriented policies offset tariff uncertainty, boosting returns for a potentially reinvigorated Europe.

- Domestic equities moved lower on weak consumer and business sentiment. Mega-cap technology and consumer discretionary stocks were most exposed to the momentum unwind.

- International stocks rallied on improving growth prospects, dollar weakness, and lower valuations relative to U.S. equities.

- Bonds yields moved lower in anticipation of slower economic activity but were limited by competing factors, including a Fed pause, fiscal policy and inflation uncertainty, and rising rates across Europe.

- Commodities benefited from dollar weakness. Investors turned to gold amid economic uncertainty and energy as an inflation hedge.

- Real estate gained as rates moved lower, though economic uncertainty remained a headwind.

Asset class returns are represented by the following indexes: Bloomberg U.S. Aggregate Bond Index (U.S. bonds), S&P 500 Index (U.S. large-cap stocks), Russell 2000® (U.S. small-cap stocks), MSCI EAFE Index (international developed market stocks), MSCI Emerging Market Index (emerging market stocks), Dow Jones U.S. Real Estate Index (real estate), and Bloomberg Commodity Index (commodities). Past performance is no guarantee of future results. Indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly. Please refer to index definitions and other important disclosures provided at the end of this presentation.

IS POLICY UNCERTAINTY NEARING AN END?

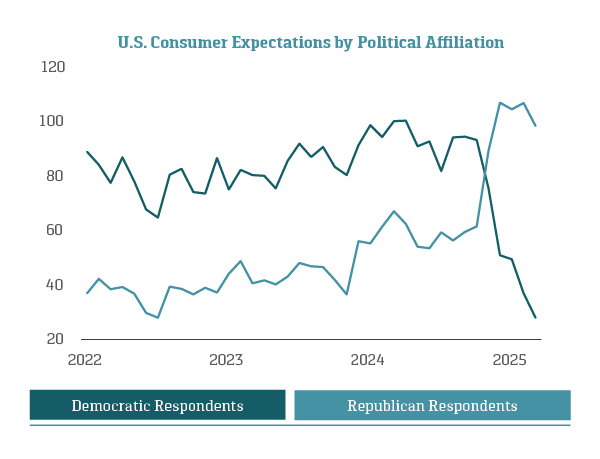

It is not unusual for markets to experience volatility in the first year of a new president’s term, as proposals and new policies create questions. The new administration is advancing multiple proposals simultaneously, sending uncertainty soaring. This chaotic state is only sustainable so long as voters remain confident.

Consumers have shown concern about the impact of President Trump’s policy initiatives. Unsurprisingly, Democratic respondents have been skeptical since Inauguration Day. However, Republican respondents also recently have shown signs of concern, indicating the grace period for policymakers may be ending.

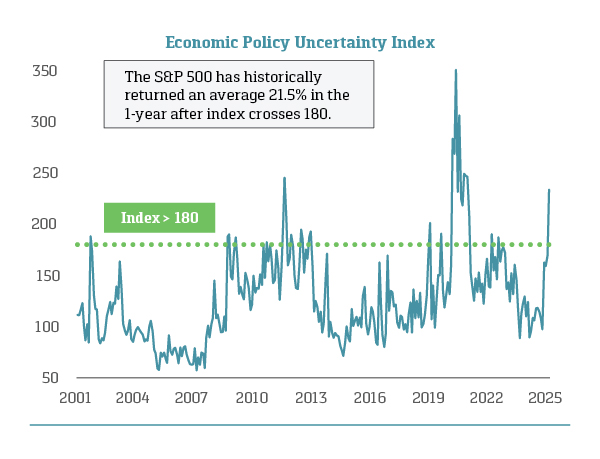

The U.S. Economic Policy Uncertainty Index spiked in February, reaching levels last exceeded during the COVID-19 crisis. While markets generally weaken during periods of uncertainty, the average one-year return following peaks of policy uncertainty has been a robust 21.5% gain.

Sources: University of Michigan Consumer Survey, policyuncertainty.com, Strategas, CAPTRUST research