While markets have continued their uneven climb this quarter, our role as your fiduciary remains unchanged: to navigate with discipline, not distraction. Volatility can tempt short-term reactions, but our focus stays firmly on your long-term objectives. By maintaining a diversified, principles-based approach, we turn market noise into background hum—allowing us to keep our eyes on the road ahead and our hands steady on the wheel. We are deeply grateful for the trust of our ministry partners and the opportunity to serve you. Our team is always available for consultations and educational sessions to help you feel confident and informed about your financial future.

ECONOMIC OUTLOOK

| Despite policy shifts, geopolitical tensions, and mounting concerns about long-term debt, the U.S. economy has been resilient. Consumers and corporations have demonstrated an ability to move forward with caution, even in the face of significant risk. However, a wide range of outcomes is still possible. |

HEADWINDS

Awaiting Greater Clarity

- Policy uncertainty continues to threaten near-term economic activity.

- The Federal Reserve maintains a wait-and-see approach, following the data and monitoring fiscal policy impact before making changes.

- The housing market remains in limbo as an affordability gap keeps buyers on the sidelines. An uptick in supply could create disinflationary pressures or could lower home equity values.

Long-Term Detractors

- Soaring government debt is unsustainable, and fiscal solutions are unlikely in the near term. Economic stability relies on corporate and consumer balance sheets as we await productivity gains from artificial intelligence (AI).

- An aging population and fewer immigrants may reduce labor force participation, weighing on future economic growth.

TAILWINDS

Balance Sheet Strength

- Despite waning sentiment, consumer financial conditions remain solid, aided by a cooling yet stable labor market and moderating inflation. Recent tax reform may lead to higher confidence and spending.

- Corporate fundamentals have been resilient. Businesses seem to be digesting tariff impacts, maintaining profitability and adding shareholder value through stock buybacks. Regulatory uncertainty and tax reform could create a favorable backdrop for elevated buyback activity.

Long-Term Contributors

- AI adoption will fuel productivity and will be key to future economic growth.

- Improved access to exponential knowledge will drive more efficient solutions and advancements for businesses and governments.

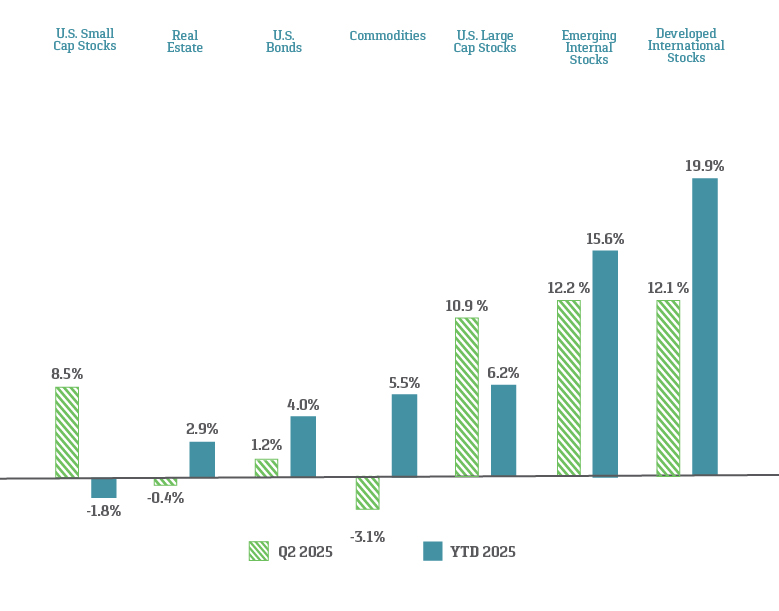

MARKET RECOVERS IN VOLATILE QUARTER

| A sharp selloff ushered in the second quarter as U.S. trade policies shook global markets. A gradual easing in tariff rhetoric and ongoing strength in economic data moderated investor fears, even as geopolitical tensions escalated. U.S. markets ended the quarter at all-time highs, while dollar weakness bolstered gains for a reinvigorated Europe. |

- U.S. equities climbed with market leadership rotating back to the communication services and technology sectors after solid earnings.

- U.S. dollar depreciation was a tailwind for international stocks along with improving growth prospects and easing trade tensions.

- Fixed income assets added to their 2025 gains despite a volatile quarter and mounting concerns about the sustainability of U.S. federal debt levels.

- Weakened demand and oversupply concerns dragged on commodities and energy prices. Gold continues to be a safe-haven asset amid economic and geopolitical uncertainty.

- Real estate fell amid weakening investor sentiment and yield volatility.

Asset class returns are represented by the following indexes: Bloomberg U.S. Aggregate Bond Index (U.S. bonds), S&P 500 Index (U.S. large-cap stocks), Russell 2000® (U.S. small-cap stocks), MSCI EAFE Index (international developed market stocks), MSCI Emerging Market Index (emerging market stocks), Dow Jones U.S. Real Estate Index (real estate), and Bloomberg Commodity Index (commodities). Past performance is no guarantee of future results. Indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly. Please refer to index definitions and other important disclosures provided at the end of this presentation.

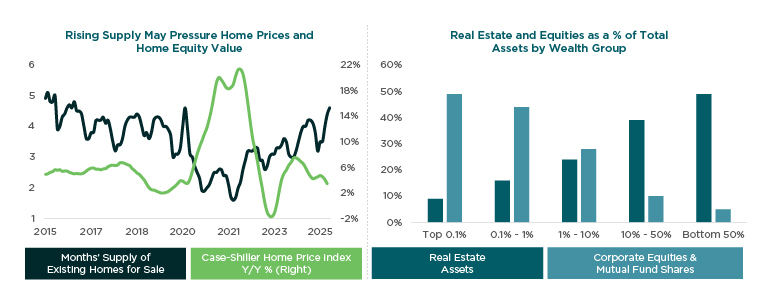

MORE INVENTORY MAY NOT SOLVE HOUSING WOES

Housing remains frozen in an otherwise stable economy. Would-be sellers feel locked in by extremely low existing mortgage rates. Would-be buyers feel locked out by soaring homeownership costs. However, the supply-demand imbalance that has plagued the market appears to be slowly shifting in some regions.

| In May, the monthly supply of homes for sale reached levels last seen in mid-2016. With potential homebuyers remaining on the sidelines and inventory rising, the housing market will likely continue to experience disinflationary effects. The Case-Shiller Home Price Index has already slowed from prices increasing 7% year-over-year (Y/Y) in February 2024 to just 3% in April 2025. However, if a longer sales cycle ultimately leads to falling home prices, current owners and prospective buyers could lose confidence due to the negative wealth effect. A national housing crisis is highly unlikely. However, certain regions and population segments are vulnerable, particularly owners in the bottom 50% of U.S. wealth brackets, where real estate accounts for nearly 50% of household assets. |

Sources: National Association of Realtors, S&P CoreLogic Case-Shiller U.S. National Home Price Index, FactSet, Strategas, CAPTRUST research

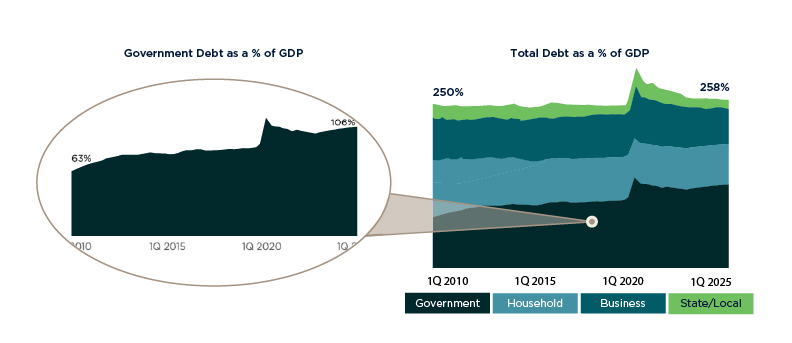

DEBT RISKS ECONOMIC SUCCESS

| Government debt remains the largest single risk to long-term U.S. economic prosperity. Current deficit levels are unsustainable, but both potential solutions—raising taxes or cutting spending—have faced political pushback. Consequently, economic growth must drive a long-term fix. Fortunately, consumers and businesses have much stronger balance sheets than the federal government and may be able to support continued growth while the country awaits AI productivity gains. |

Federal debt has risen steadily since 2010, currently equaling 106% of gross domestic product (GDP). The Congressional Budget Office estimates this ratio will continue rising over the next decade, with interest expense projected to grow twice as fast as revenue.

While the government continues to amass debt, companies and consumers have de-levered their balance sheets, holding the total-debt-to-GDP ratio fairly stable since 2010.

Sources: Federal Reserve; Congressional Budget Office; CAPTRUST research. Data as of March 2025.