The third quarter brought signs of cautious optimism across the financial landscape. Markets continue their dance with shifting interest-rate expectations and evolving economic signals, yet we remain encouraged by steady resilience and the thoughtful stewardship we see across our ministry partners.

In this environment, wisdom looks like patience, prudence, and purpose. Our investment approach continues to emphasize disciplined diversification and long-term perspective, always guided by our commitment to theologically aligned investments that reflect our mission and values. We aim for progress that endures, not headlines that fade.

This quarter, we were also honored to receive our seventh consecutive CEFEX certification, affirming our adherence to the highest fiduciary standards in investment stewardship. This recognition underscores what we seek to demonstrate every day: careful, transparent, and faithful management of the resources entrusted to us.

Thank you for your continued trust and partnership. Together, we move forward with steady confidence, hopeful hearts, and a commitment to stewarding God’s gifts with excellence.

ECONOMIC OUTLOOK

| The U.S. economy continues to exceed expectations, supported by fiscal stimulus and a long-awaited Fed rate cut. Despite tariff concerns and stubborn inflation, businesses are plowing profits into investments for the future, and consumers continue to spend. Yet a long list of uncertainties remains, including unproven payoffs from AI investments, the future path of rate cuts, geopolitical conflicts, and political tensions. |

HEADWINDS

Labor Market Equilibrium

- The labor market is in a relatively fragile state of balance, as both the supply of and demand for workers has decreased. Weakness is not widespread, but public sector layoffs are a risk.

Consumer Concerns

- Sentiment has weakened as consumers grapple with a softening labor market, unknown tariff impacts, and political tensions. Still, retail spending remains positive, driven by higher-income households.

Elevated Investment, Elevated Expectations

- As innovation and investment continue at a rapid pace, valuations for AI-related stocks have climbed. Expectations are lofty, and any setbacks could bring outsized impacts.

- The One Big Beautiful Bill Act (OBBBA), the largest fiscal package in a decade, will exacerbate an already-concerning public debt burden.

TAILWINDS

Corporate Profitability Provides Catalyst

- Corporations have managed to drive earnings higher despite higher input prices and tariff uncertainty. Strong fundamentals support elevated equity prices and ongoing investment.

- Investment in AI infrastructure continues to rise, supported by corporate earnings growth and tax incentives. Massive capital spending supports the economy today, while the prospect of productivity gains brightens the outlook.

Fiscal and Monetary Policy Rescue

- The OBBBA will provide near-term fiscal stimulus to consumers, small businesses, and corporations through far-reaching tax breaks and incentives.

- Meanwhile, the Federal Reserve has begun easing monetary policy, prompted by labor market conditions. Although rate cuts during periods of strength are unusual, investors are optimistic that September’s cut is the first of many.

MARKETS FOCUSED ON THE POSITIVES IN STRONG QUARTER

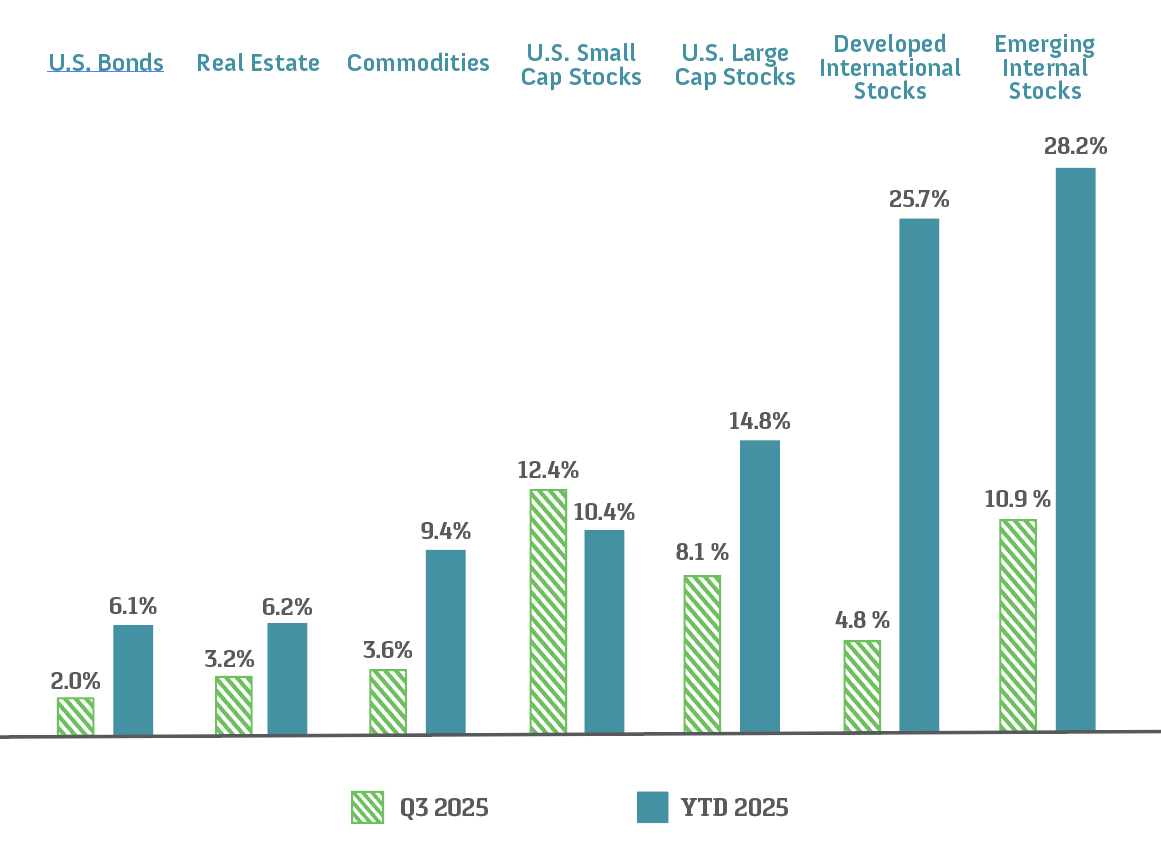

| Markets rallied in the third quarter as trade tensions abated, AI-infrastructure investment abounded, and the Federal Reserve delivered its first cut of 2025. While signs of U.S. labor market softening raised concerns, other indicators point toward economic stability. U.S. market breadth improved, and dollar weakness helped international stocks. |

- U.S. stocks posted a strong quarter, buoyed by tech spending, expectations for additional rate cuts, and solid earnings as tariff costs were largely mitigated.

- AI investment, an easing regulatory backdrop, and reduced trade frictions lifted emerging market stocks, with China leading the way.

- Bonds generated modest returns, underpinned by falling short-term yields and a pivot toward Fed rate cuts, despite fiscal-debt concerns and an uptick in inflation.

- Commodities rebounded, led by gold’s impressive rally as investors sought safe-haven assets amid economic and geopolitical uncertainty.

- Real estate moved higher on falling rate expectations.

Asset class returns are represented by the following indexes: Bloomberg U.S. Aggregate Bond Index (U.S. bonds), S&P 500 Index (U.S. large-cap stocks), Russell 2000® (U.S. small-cap stocks), MSCI EAFE Index (international developed market stocks), MSCI Emerging Market Index (emerging market stocks), Dow Jones U.S. Real Estate Index (real estate), and Bloomberg Commodity Index (commodities). Past performance is no guarantee of future results. Indexes are unmanaged; do not incur management fees, costs, and expenses; and cannot be invested in directly. Please refer to the index definitions and other important disclosures provided at the end of this presentation.

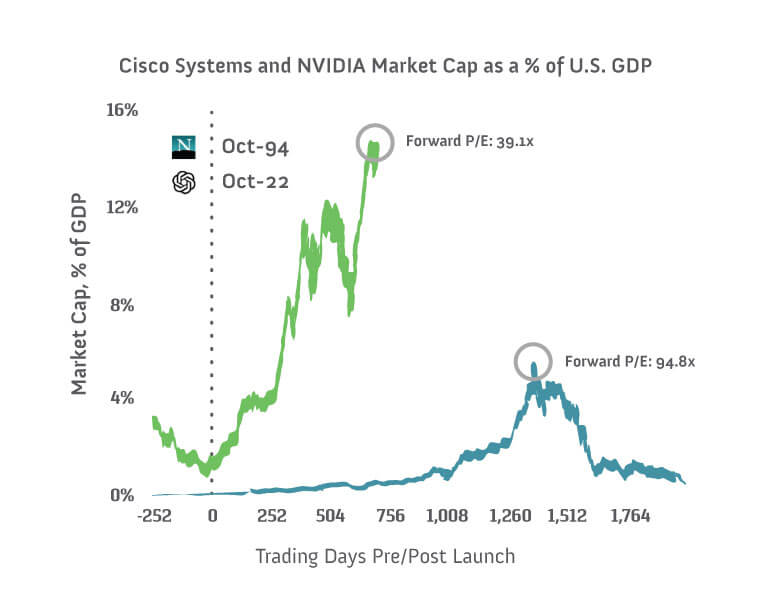

TECH BOOM DÉJÀ VU

Entirely new economic eras can be triggered by a single innovation. The steam engine, Wright brothers’ Flyer, Sputnik 1, and the transistor each marked inflection points with massive economic implications. In 1994, Netscape Navigator lit the fuse for the Internet revolution and an unprecedented stock market frenzy. Nearly three decades later, the launch of ChatGPT 3.5 can be seen as a similar event. The parallels are striking, with the promise of transformational productivity gains. We know how the dot-com era ended.

THEN VS. NOW

- The AI-fueled rally has advanced far faster than dotcom mania, sparking fears of another bubble.

- Adoption velocity—The Internet reached 100 million users in seven years, while ChatGPT achieved the same number in just two months.

- Infrastructure splurge—Telecommunications companies laid nearly $90 billion worth of fiber optic cable in the 2000s. This year, major technology firms will invest an estimated $400 billion in AI data centers and infrastructure.

- Cisco—At the forefront of the dot-com era’s infrastructure buildout, Cisco Systems reached a peak market cap of 6% of GDP. Its stock was priced at nearly 95 times forward earnings.

- NVIDIA—The leader of this era’s infrastructure build has seen its market cap eclipse $4 trillion, more than 14% of GDP. Yet earnings are supported by insatiable demand for AI chips. Its forward price-to-earnings multiple is less than 40.

Sources: Bloomberg, World Bank, Wall Street Journal, CAPTRUST research.

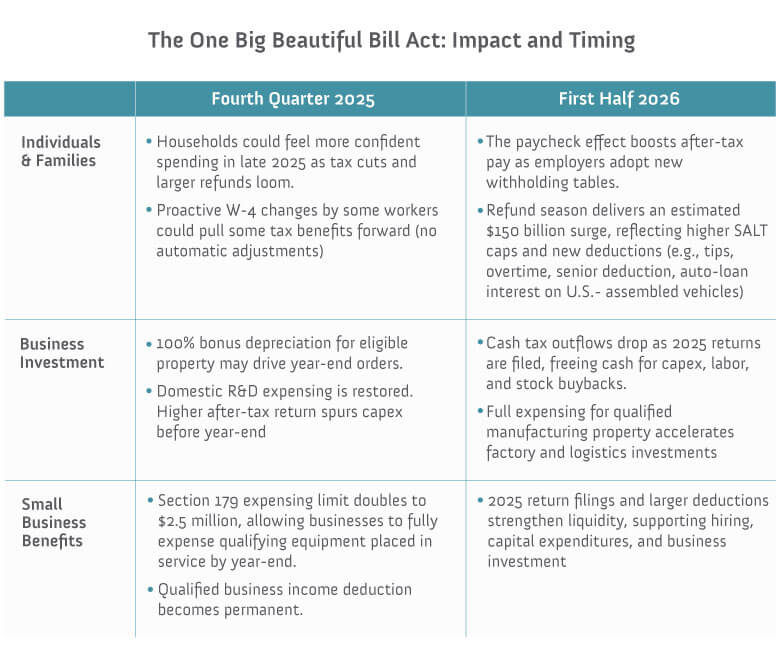

ONE BIG FISCAL BOOST, BUT AT WHAT COST?

| The One Big Beautiful Bill Act (OBBBA) is far more than an extension of President Trump’s first-term tax cuts. Taxpayers will begin to feel its effects later this year, accelerating into early 2026. The front-loaded effects could sustain consumer spending and business investment through mid-2026 even if hiring cools. However, near-term benefits could be followed by a caffeine crash in the form of surging deficits and public debt. |

The Congressional Budget Office projects the OBBBA will worsen the budget deficit by $3.4 trillion over the next decade and drive public debt to 156% of GDP in 2055. The added stress on the U.S. Treasury market from higher debt issuance and risk perception could lead to higher and more volatile interest rates. The benefits of OBBBA are skewed, with top earners’ income projected to rise 2.7% by 2034, while the bottom decile of earners could see income fall by 3.1%. The law could cause an estimated 10 million Americans to lose health insurance coverage by 2034.

Sources: Congressional Budget Office, IRS.gov, Strategas, Grant Thornton, Wall Street Journal, Bipartisan Policy Center, CAPTRUST research. This communication is for informational purposes only and does not constitute tax advice.

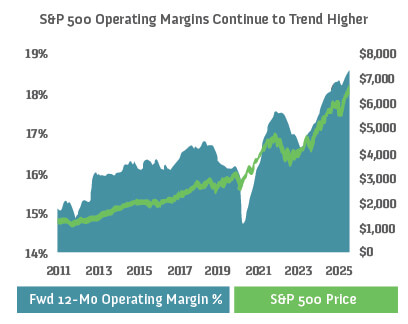

MARGINS DRIVE INVESTMENT, GROWTH

This year, the U.S. economy and markets have performed better than expected. Corporations have grown revenue and earnings despite tariff related cost pressures. This has translated to robust capital spending, set to accelerate due to tax bill incentives. When strong fundamentals provide companies with the means and confidence to invest, the economy and markets can often power through headwinds.

- Companies have absorbed rising input costs and tariff pressures through strategic price pass-through, supply chain optimization, cost management, and productivity gains.

- Margin expansion has amplified earnings growth, supporting equity prices even at above-average valuations.

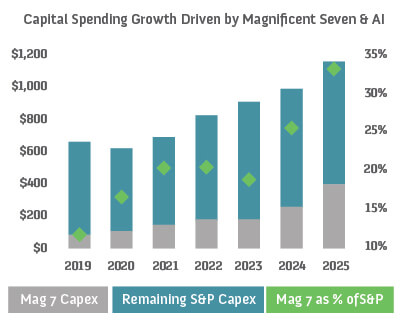

- The Magnificent Seven have more than tripled capital spending since 2020, with profitability fueling investment. Both are contributing to broader economic growth.

- Magnificent Seven’s share of capex has climbed, amplifying sensitivity to this cohort. For companies with more modest free cash flow, returns from aggressive AI spending will be critical.

Sources: Strategas, FactSet, CAPTRUST research. Data as of September 30, 2025.